You’re a military member or family looking at USAA for travel insurance because you trust the brand.

Maybe you’ve banked with USAA for years and assume their travel insurance offers the same military-focused value you’ve come to expect.

After researching USAA’s travel insurance offerings and comparing them against standalone policies for dozens of military families, I need to share something important: USAA doesn’t actually underwrite travel insurance themselves.

In this comprehensive review, I’ll explain exactly how USAA travel insurance works, what coverage you actually get, and whether the military connection provides real value or just familiar branding.

In this article...

About the Company

USAA doesn’t create or sell travel insurance policies directly. Instead, they partner with Allianz Global Assistance to offer plans to their members. These plans are accessible through USAA’s portal but are actually underwritten and serviced by Allianz.

This arrangement combines USAA’s member-focused customer service with Allianz’s established travel insurance expertise and global assistance network.

Allianz Global Assistance maintains an A+ rating from AM Best, indicating strong financial stability and claims-paying ability.

Allianz processes over 1.5 million policies annually across multiple countries, giving them extensive experience with travel insurance claims.

USAA acts as the distributor, leveraging their military membership base, while Allianz handles the actual insurance underwriting and most claims processing.

USAA Coverage Details

USAA offers single-trip insurance for U.S. military members through their partnership with Allianz Global Assistance.

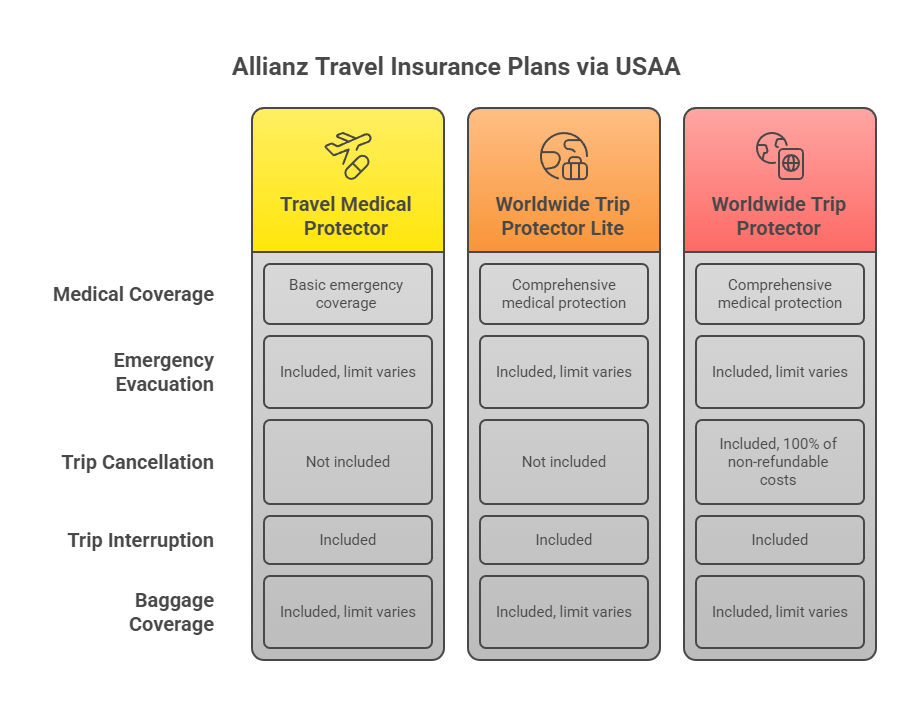

The coverage includes three main plan levels: Travel Medical Protector, Worldwide Trip Protector Lite, and Worldwide Trip Protector.

Medical Coverage: Ranges from basic emergency medical coverage to comprehensive medical protection depending on the plan selected.

Emergency Evacuation: All plans include evacuation coverage, with limits varying by plan tier.

Trip Cancellation: Available on higher-tier plans, covering 100% of non-refundable trip costs for covered reasons including illness and military deployment changes.

Trip Interruption: Provides coverage if you need to cut your trip short due to covered emergencies.

Baggage Coverage: Protection for lost, stolen, or damaged luggage with limits varying by plan level.

The coverage mirrors standard Allianz travel insurance plans but is marketed specifically to military families through USAA’s platform.

💡 Personal Note: I worked with a Navy family whose deployment got extended unexpectedly, canceling their planned European vacation. USAA’s travel insurance (actually Allianz) covered the full $4,800 in non-refundable costs because military deployment changes are specifically covered in their policies.

Recommended Plans

Up to $2,000,000 of Overall Maximum Coverage, Emergency Medical Evacuation, Medical coverage for eligible expenses related to COVID-19, Trip Interruption & Travel Delay.

Coverage for in-patient and out-patient medical accidents up to $1 Million, Coverage of acute episodes of pre-existing conditions, Coverage from 5 days to 364 days (about 12 months).

Up to $8,000,000 limits, Emergency Medical Evacuation, Coinsurance for treatment received in the U.S. (100% within PPO Network), Acute Onset of Pre-Existing Conditions covered.

USAA Plan Highlights

Military-Specific Coverage: Includes coverage for trip cancellation due to military deployment changes and emergency military duty, which standard travel insurance often excludes.

Integrated USAA Experience: Seamless coordination with other USAA services and familiar customer service for military families.

Multiple Plan Options: Three tiers allow you to match coverage to your specific travel needs and budget.

Pre-Existing Medical Condition Coverage: Available when purchased within the required timeframe after initial trip deposit.

24/7 Emergency Assistance: Access to Allianz’s global assistance network with military-aware customer service representatives.

Family-Friendly Coverage: Plans designed to accommodate military families with children and extended family travel.

Worldwide Coverage: Protection for international travel, which is common among military families stationed overseas.

Cancel For Any Reason Option: Available only on the Worldwide Trip Protector plan, which is the most comprehensive travel insurance plan offered by USAA.

Pricing Insights

USAA’s Travel Medical Protector plans are more affordable than its other options due to benefits and limits offered in each of the plans.

The pricing reflects standard Allianz rates but may include slight discounts for USAA members.

For budget-conscious military families, the Travel Medical Protector provides basic coverage at lower costs.

Higher-tier plans with comprehensive trip cancellation and interruption coverage cost more but provide better protection for expensive vacations.

The total cost for coverage typically varies based on your total trip cost and your age.

Expect to pay 4-8% of your total trip cost depending on the plan level and your specific circumstances.

Features

| Coverage Type | Travel Medical Protector | Worldwide Trip Protector |

|---|---|---|

| Emergency Medical | Basic coverage | Enhanced coverage |

| Emergency Evacuation | Standard limits | Higher limits |

| Trip Cancellation | Not included | 100% of trip cost |

| Trip Interruption | Limited | 150% of trip cost |

| Baggage Protection | Basic limits | Enhanced limits |

| Military Deployment Coverage | ✓ | ✓ |

Buying Travel Insurance Online

Can Save Up to 30%!

Exclusions and Limitations

Pre-Existing Medical Conditions: USAA Visa travel insurance often excludes coverage for pre-existing medical conditions unless specific requirements are met.

High-Risk Activities: Standard exclusions for extreme sports and certain adventure activities unless additional coverage is purchased.

Geographic Restrictions: Limited or no coverage for countries with active government travel advisories.

Age Limitations: Some coverage restrictions for older military retirees and family members.

Business Equipment: Limited coverage for military equipment or work-related items compared to specialized policies.

Deployment Extensions: While covered, specific documentation requirements may apply for military-related cancellations.

❌ Avoid: USAA travel insurance if you need extensive adventure sports coverage or frequently travel to high-risk destinations, as the exclusions are similar to standard Allianz policies without military-specific enhancements in these areas.

Plan Overview

USAA travel insurance provides military members and families with access to Allianz travel insurance plans through USAA’s familiar platform and customer service.

The plans offer standard travel protection with some military-specific enhancements like deployment coverage.

Most suitable for military families who prefer working with USAA and want reliable travel protection without researching multiple insurance providers.

Ideal Buyer Profile

USAA travel insurance works best for military members and families who already use USAA services and want convenient, military-aware travel protection.

Perfect for families taking annual leave vacations, military personnel on PCS moves with family travel, and those who value the familiarity of USAA customer service.

The military-specific coverage enhancements make it particularly suitable for active duty families whose travel plans can change due to military obligations.

Not ideal for adventure travelers needing extensive activity coverage, budget-conscious families seeking the lowest rates, or travelers wanting cutting-edge travel insurance features.

Retirees and veterans with complex medical needs might find better specialized coverage with other providers.

User Feedback

Military families highlight 24/7 hotline support and smooth claims process as major benefits when dealing with USAA travel insurance.

USAA Travel Insurance is STRONGLY RECOMMENDED based on reviews, particularly among military families who appreciate the military-aware customer service.

Military families frequently praise the understanding of deployment-related issues that other insurance providers may not recognize or accommodate.

Common complaints focus on the realization that it’s actually Allianz insurance sold through USAA, leading some to question whether direct Allianz purchase might offer better rates.

The integrated USAA experience receives positive feedback from families who want single-provider convenience.

*ℹ️ Fun Fact: USAA travel insurance covers military deployment changes as a standard feature, while most civilian travel insurance policies require expensive upgrades or exclude work-related cancellations entirely.

Pros and Cons

| Pros | Cons |

|---|---|

| Military-specific coverage for deployment changes | Actually Allianz insurance with USAA branding |

| Familiar USAA customer service experience | May cost more than direct Allianz purchase |

| Integrated with other USAA services | Limited to USAA members only |

| Understanding of military family needs | Standard exclusions still apply |

| Multiple plan tiers for different budgets | Not always the most comprehensive coverage |

| 24/7 assistance with military awareness | Age restrictions for some family members |

Alternatives to Consider

Direct Allianz Travel Insurance: Since USAA uses Allianz anyway, purchasing directly from Allianz might offer more plan options and potentially better pricing.

Military-specific providers: Some companies specialize in military travel insurance with more comprehensive deployment and duty change coverage.

Compared to Travel Guard, USAA travel insurance offers military-specific benefits but may have lower medical coverage limits on basic plans.

✅ Pro Tip: Before purchasing through USAA, get a quote directly from Allianz Travel Insurance to compare pricing and plan options. You might find better value or more suitable coverage levels by going direct.

Final Recommendation

USAA travel insurance provides solid protection through the trusted Allianz platform with the added convenience of military-aware customer service.

The military-specific enhancements, particularly deployment coverage, offer genuine value for active duty families whose travel plans can change due to military obligations.

Choose USAA travel insurance if you value the integrated USAA experience and need the military-specific coverage enhancements for deployment and duty changes.

The familiarity and customer service quality make it a reasonable choice for military families who want hassle-free travel protection.

Consider direct Allianz purchase or other providers if you want to compare pricing without the USAA markup, need specialized adventure coverage, or want maximum medical coverage limits.

For comprehensive coverage options, you can compare travel insurance policies here.

Always review the full policy wording carefully before purchasing. Safe travels!

Buying Travel Insurance Online

Can Save Up to 30%!